Washington Cannabis Business Startup Costs and Fees: Complete Guide for Dispensary Owners

- Washington Cannabis Business Startup Costs and Fees: What to Expect

- Quick overview of Washington cannabis business startup costs and fees

- Why people search washington cannabis business startup costs and fees

- State licensing and application fees (what the LCB requires)

- Mandatory taxes: 37% state excise plus local sales and B&O taxes

- Real estate, leasehold improvements, and build-out costs

- Security, surveillance, and compliance infrastructure

- Inventory purchasing and product sourcing costs

- Point-of-sale, seed-to-sale tracking, and IT systems

- Staffing, payroll, and training costs

- Insurance, banking, and professional services

- Ongoing operational costs and working capital needs

- Typical budget comparison: low, medium, and high startup scenarios

- Practical strategies to reduce startup costs and manage fees

- Why high-quality displays and fixtures matter (and how Ouyee helps)

- Checklist: immediate next steps for prospective Washington dispensary owners

- Conclusion: budgeting realistically for Washington cannabis startup costs and fees

- Frequently Asked Questions

- Sources and references

Washington Cannabis Business Startup Costs and Fees: What to Expect

Quick overview of Washington cannabis business startup costs and fees

Starting a cannabis business in Washington requires careful planning around licensing, state and local fees, high excise and sales taxes, real estate and build-out, inventory, security, and ongoing compliance costs. Typical total startup costs for a retail dispensary in Washington range from approximately $250,000 for a small shop to $1M+ for mid-to-large operations, depending on location, build-out scope, and inventory depth. This article breaks down those costs, explains mandatory fees and taxes, and offers budgeting tips specifically useful for dispensary owners and retail contractors—including display providers like Ouyee Dispensary Displays.

Why people search washington cannabis business startup costs and fees

Searchers looking for washington cannabis business startup costs and fees are usually evaluating feasibility: entrepreneurs estimating capital requirements, investors comparing markets, or existing retailers planning expansions. They need clear cost ranges, mandatory regulatory fees (state and local), and tax impacts—especially Washington’s 37% retail excise tax and federal 280E restrictions—so they can build realistic pro forma financials.

State licensing and application fees (what the LCB requires)

Licensing fees in Washington are administered by the Washington State Liquor and Cannabis Board (LCB). Costs include application fees, background checks, investigative fees, and license issuance/renewal fees. While amounts vary by license type (producer, processor, retailer), applicants should budget for application and investigation fees of several hundred to a few thousand dollars, plus any local licensing costs. Always consult the LCB fee schedule for the specific license you plan to apply for.

Mandatory taxes: 37% state excise plus local sales and B&O taxes

Washington’s retail cannabis excise tax is 37% of the retail price; this tax is layered on top of local sales taxes, which vary by jurisdiction. Businesses also remain subject to Business & Occupation (B&O) taxes and other municipal business taxes. Additionally, federal tax code Section 280E disallows most ordinary business deductions for federally illegal substances, significantly increasing effective tax burdens. These tax rules are a major driver of cash-flow pressure for cannabis retailers in Washington.

Real estate, leasehold improvements, and build-out costs

Location is a major cost driver. Lease rates in urban centers like Seattle are substantially higher than suburban/rural locations. Typical retail build-outs for dispensaries—accounting for secure walls, point-of-sale areas, customer flow, ADA compliance, and professional display fixtures—range from $75,000 to $500,000 or more. Custom security glazing, safes, HVAC and specialized electrical work can push costs higher. High-quality dispensary display cabinets (secure, lockable, with integrated lighting) are essential; manufacturers like Ouyee can supply custom fixtures to improve sales floor efficiency and compliance.

Security, surveillance, and compliance infrastructure

Washington LCB security rules require alarm systems, 24/7 video surveillance with specified retention periods, restricted access areas, and secure storage for inventory. Budget $15,000–$100,000+ for compliant security design and installation depending on property size and desired system redundancy. These systems are non-negotiable and often integrated with POS and inventory tracking systems to satisfy audits.

Inventory purchasing and product sourcing costs

Initial inventory is a substantial upfront cost. Depending on product breadth—flower, pre-rolls, concentrates, edibles, tinctures—initial purchasing can range from $50,000 to $300,000+. Retailers must also factor in wholesale price volatility, minimum order quantities from producers/processors, and the cost of quality-assurance testing required by Washington regulations.

Point-of-sale, seed-to-sale tracking, and IT systems

Integrated POS and traceability systems (seed-to-sale tracking) are required and must integrate with state systems. Implementation and setup can run $10,000–$50,000, with monthly software-as-a-service fees. Reliable IT, payment reconciliation, and cash-management systems are critical because many cannabis businesses operate largely in cash due to limited banking options.

Staffing, payroll, and training costs

Wages, payroll taxes, training, and hiring costs should be budgeted carefully. Staff knowledgeable in compliance, product science, and customer service add value but cost more. Initial payroll costs for a small dispensary (manager + budtenders + security) may be $15,000–$30,000 per month, depending on headcount and local wage levels.

Insurance, banking, and professional services

Insurance High Qualitys for cannabis retailers (general liability, product liability, property, crime) are higher than for many other retail sectors. Expect to budget several thousand dollars annually. Professional fees (attorneys, accountants experienced in cannabis law and 280E tax planning) are essential—plan for recurring monthly advisory and accounting fees to ensure compliance and accurate tax filings.

Ongoing operational costs and working capital needs

Given the high taxes and limited deductions, dispensaries generally require larger cash reserves for operations. Working capital needs—covering payroll, inventory replenishment, rent, and taxes—are substantial. Many operators keep 3–6 months of operating expenses in reserve when launching.

Typical budget comparison: low, medium, and high startup scenarios

Below is a simple comparison table estimating total startup cost ranges for retail dispensaries in Washington. These are illustrative ranges—actual costs will vary by city, property, licensing history, and scale.

| Cost Category | Small Shop (Low) | Mid-size Dispensary (Medium) | Large/Flagship (High) |

|---|---|---|---|

| Licensing & application fees | $2,000–$10,000 | $5,000–$25,000 | $10,000–$50,000+ |

| Build-out & fixtures (including dispensary displays) | $50,000–$100,000 | $100,000–$350,000 | $350,000–$1,200,000+ |

| Security & surveillance | $15,000–$30,000 | $30,000–$75,000 | $75,000–$200,000+ |

| Initial inventory | $50,000–$100,000 | $100,000–$250,000 | $250,000–$1,000,000+ |

| POS / seed-to-sale / IT | $10,000–$20,000 | $20,000–$50,000 | $50,000–$150,000 |

| Working capital (3–6 months) | $30,000–$80,000 | $80,000–$250,000 | $250,000–$800,000+ |

| Estimated total | $250,000–$500,000 | $500,000–$1,200,000 | $1,200,000–$3,500,000+ |

Practical strategies to reduce startup costs and manage fees

To control costs: choose a location with favorable rent and zoning, negotiate build-out allowances with landlords, phase inventory purchases, and invest in durable, modular displays (which reduce future renovation expenses). Work with experienced cannabis-focused attorneys and accountants to navigate LCB processes and tax planning (including making the most of allowable COGS deductions to mitigate 280E impacts where possible).

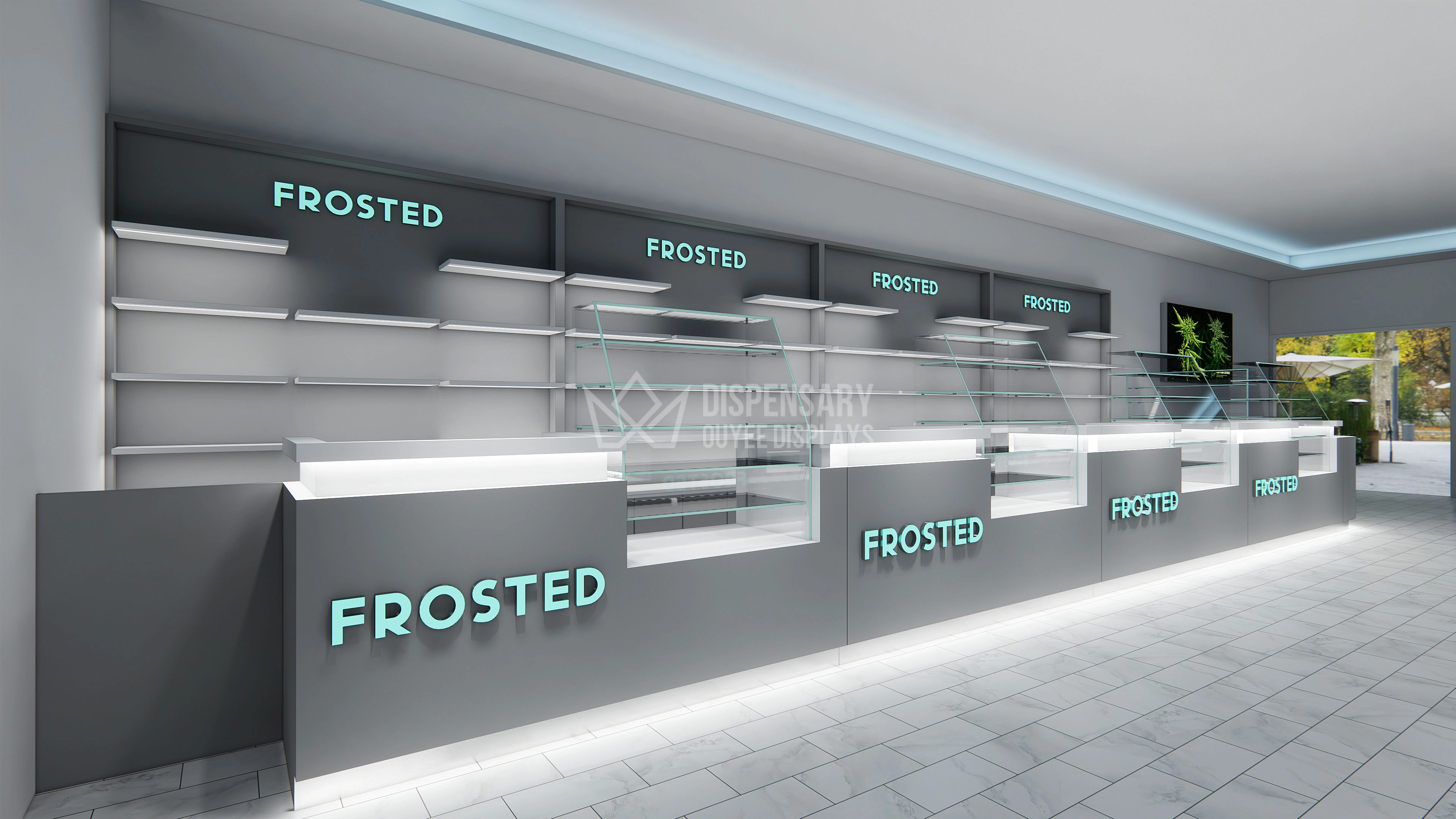

Why high-quality displays and fixtures matter (and how Ouyee helps)

Retail presentation affects conversion and compliance. Secure, well-designed dispensary display cabinets improve customer experience, reduce theft risk, and support compliance with product visibility and access rules. Ouyee Dispensary Displays—operating from a 180,000 sq. ft. Guangzhou facility with 25+ years of experience—specializes in custom, secure, and aesthetically aligned display solutions for cannabis retailers, helping owners get efficient fixtures that last and reduce long-term rebuild costs.

Checklist: immediate next steps for prospective Washington dispensary owners

1) Review LCB licensing and local municipal requirements for your target city; 2) Run a conservative pro forma including 37% excise and 280E; 3) Secure letters of intent for a compliant property and review lease build-out allowances; 4) Get multiple bids for security and POS systems; 5) Plan initial inventory purchases with supplier terms; 6) Engage a cannabis-specialty CPA and attorney early.

Conclusion: budgeting realistically for Washington cannabis startup costs and fees

Launching a cannabis retail business in Washington requires significant upfront capital and meticulous planning around mandatory fees and taxes. Expect to budget at least a quarter-million dollars for a small operation, with many mid-sized and large dispensaries exceeding $1M once build-out, inventory, security, and taxes are accounted for. Prioritize compliance infrastructure and durable display fixtures to protect inventory, enhance customer experience, and lower long-term operating costs. Consulting reliable sources and experienced cannabis professionals will reduce surprises and improve your chances of operational success.

Frequently Asked Questions

What are the state excise and sales taxes for cannabis in Washington?Washington imposes a 37% retail excise tax on cannabis. Local sales taxes also apply and vary by jurisdiction. Businesses should factor both into pricing and cash-flow models.

How much do LCB licensing and application fees cost?LCB fees vary by license type and may include application, background investigation, and issuance/renewal fees. Budget several hundred to several thousand dollars; check the LCB fee schedule for up-to-date figures for your license type.

How much should I budget for dispensary security and surveillance?Security costs commonly range from $15,000 for small shops to well over $100,000 for larger operations, depending on camera count, alarm complexity, access control, and vault/safe specifications.

Does federal tax code affect my profitability?Yes. Section 280E disallows many ordinary business deductions for businesses selling Schedule I drugs, including cannabis, which raises effective federal tax burden. Work with a cannabis-experienced CPA to optimize allowable cost of goods sold (COGS) deductions and tax planning.

Can high-quality dispensary displays reduce startup costs long-term?Yes. Investing in secure, modular, and durable displays (customized to your layout) can reduce future renovation costs, improve sales conversion, and enhance security—delivering long-term value despite higher upfront expense.

Sources and references

- Washington State Liquor and Cannabis Board (LCB) — licensing and fee schedule (official agency materials)

- Washington State Department of Revenue — cannabis taxation and excise tax information

- Leafly — industry guides on dispensary startup costs and best practices

- Marijuana Business Daily (MJBizDaily) — market reports and startup cost analyses

- SBA and cannabis-focused accounting/legal firms — guidance on 280E and financial planning

- City of Seattle business and permitting pages — local permit requirements and zoning guidance

- Ouyee Dispensary Displays — company profile and capabilities (company website)

Top dispensary cabinets Manufacturers and Suppliers in 2026

How to Choose the dispensary display furniture manufacturer and supplier ?

Dispensary Counter Display Ideas for Pre-Rolls and Tinctures

How to Choose the dispensary retail furniture manufacturer and supplier ?

E Cigarette Display Rack Fabrication Custom Modular Vape Stands

Is this suitable for chain store rollouts?

Yes, this modular system is ideal for franchise applications, with batch production and branding consistency.

Our Team

Does Ouyee provide international services?

Yes, Ouyee works with clients globally and offers local support through our international business team and technical support staff.

Custom 3D Design Tempered Glass CBD Product Displays Solutions

How do you ensure safety during shipping?

We use multi-layer foam and wooden crates, with full knock-down packaging to prevent breakage.

Customized Wooden Cigarette And Tobacco Fixtures Smoke Shop Display Cases

Are the LED lights replaceable?

Yes, the lighting is modular and designed for easy replacement and maintenance.

Customized LED Light Strips Retail Cigarette Display Case

What’s the lead time for a bulk order?

Standard production time is 18–25 days depending on quantity and customization.

Customized Wholesale Hookah Lounge Furniture For Sale

Elevate your lounge experience with our premium customized hookah lounge furniture, designed for modern aesthetics and maximum comfort. With a strong emphasis on privacy, atmosphere, and luxury, our modular sofa systems, LED accents, and functional shisha setups are tailored to transform any space into a high-end smoking destination. Ideal for lounges, nightclubs, or upscale cafes seeking a bold, unified interior identity.

Wooden Marihuana Dispensary Shelves Cannabis Display Case Manufacturer

Premium wood display cases for cannabis dispensaries, combining natural aesthetics with secure, functional shelving solutions.

Custom Modern Minimalist LED Light Strips Good Display of Smoke Shop

Modern LED-lit custom display cases tailored for smoke shops, combining sleek aesthetics with practical storage and high visibility for merchandise.

Tempered Glass Vape Shop Fixtures CBD Retail Displays Solutions

High-end CBD retail display fixtures with tempered glass and modular cabinets. Designed for vape shops prioritizing sleek style, product visibility, and premium customer experience.

Ouyee Dispensary

Ouyee Dispensary

Ouyee Dispensary

Ouyee Dispensary